Debt Solutions

Debt Agreement

A debt agreement is a way of making regular payments towards your unsecured debts at an amount you can afford.

A debt agreement is a good way to consolidate your repayments.

Unlike debt consolidation where you have to take out a loan, with a debt agreement you can consolidate your repayments without actually borrowing more money. Another benefit of consolidating your payments instead of your debt is that you may not have to pay any interest.

Your creditors will be asked to vote on your offer and this amount can be less than your normal payments and in most cases add up to less than what you currently owe.

Whilst a debt agreement is an alternative to bankruptcy, submitting a debt agreement proposal is still classified as an “Act of Bankruptcyâ€. If the proposal is not accepted by creditors, a creditor can use this to apply to the court to make you bankrupt.

Benefits of a debt agreement

- Payments based on what you can afford

- You may be able to pay back less than what you owe

- You may not have to pay any more interest

- We speak to your creditors, so they can call us instead of you

- No more phone calls, letters or harassment

- One simple payment every week or fortnight

- Could save you thousands

- Get you back on your feet and take control

Is a debt agreement suitable for me?

If you are struggling with your current payments for your unsecured debts, but you can afford to make some sort of offer for regular payment, a debt agreement may be suitable for you.. Credit Repair Australia can help you develop an offer which will be put to your creditors for them to vote on. Should creditors accept your offer, it is possible that you could end up paying back less than the full amount of your debts.

Still have questions? Visit our FAQs page for more information on debt agreements, call us on 1300 642 199 or request a call back.

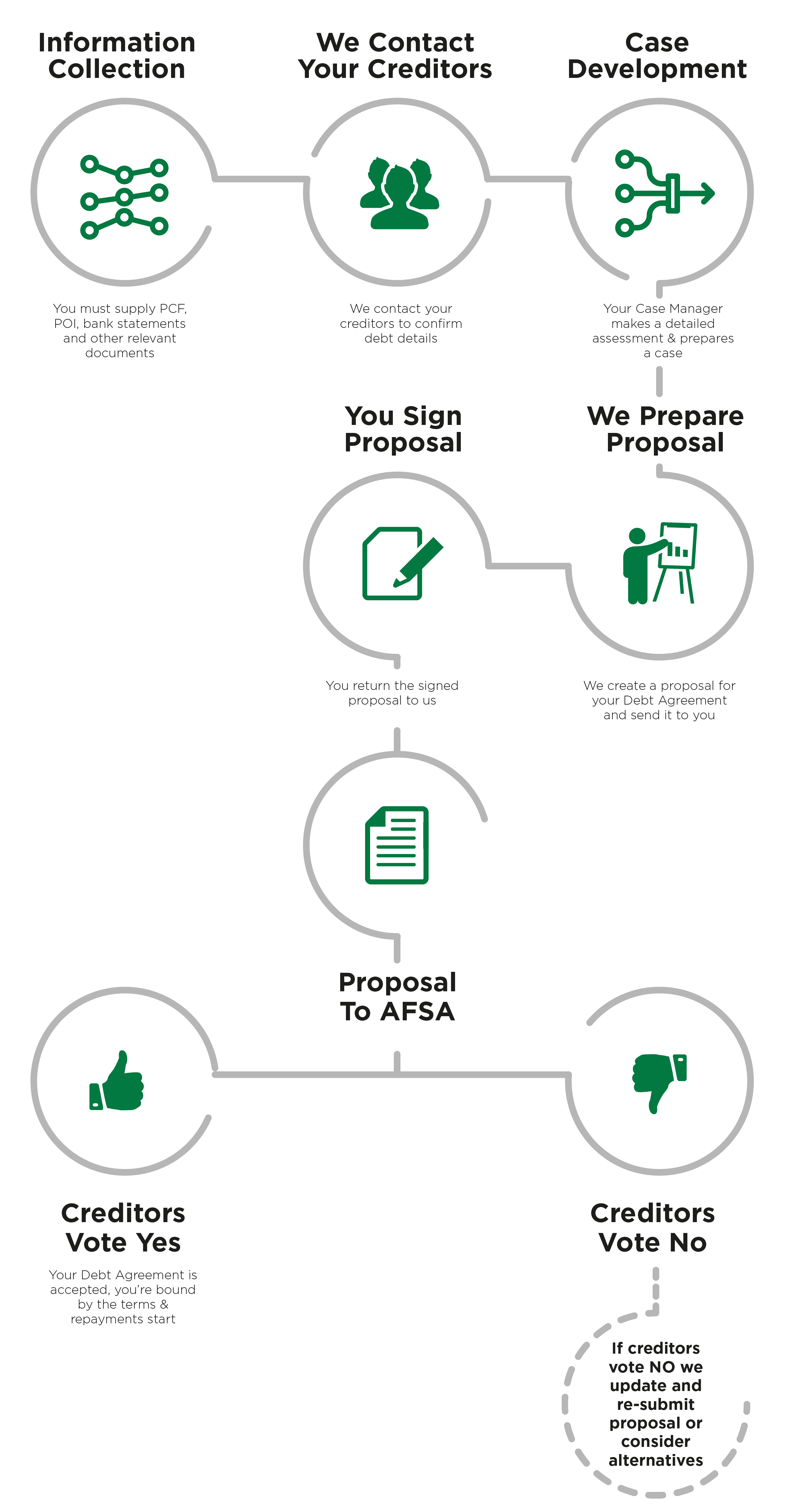

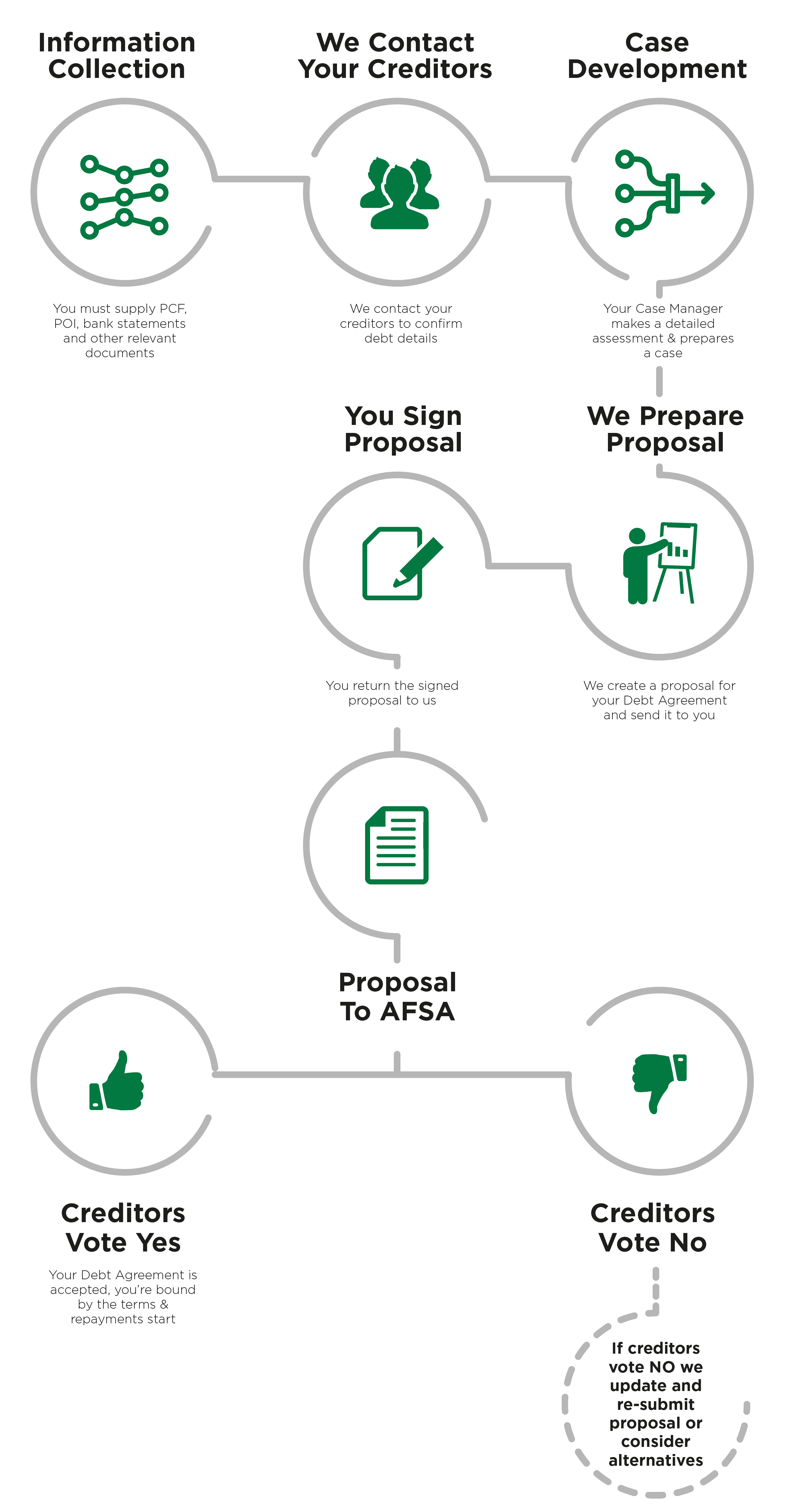

Our Debt Agreement Process

You're an Australian resident

You're an Australian resident You're between 18-65 years old

You're between 18-65 years old You or your partner have a regular income

You or your partner have a regular income You may need to borrow money or take control of your debt

You may need to borrow money or take control of your debt You may have been declined for a loan or have trouble paying your debt

You may have been declined for a loan or have trouble paying your debt We'll work with you fully understand your financial situation

We'll work with you fully understand your financial situation We will help you understand your credit report and the areas for improvement

We will help you understand your credit report and the areas for improvement You may yourself without charge obtain a copy of your credit record and challenge any entry on your credit report

You may yourself without charge obtain a copy of your credit record and challenge any entry on your credit report If you're applying for credit restoration improvement, we cannot guarantee that all adverse credit notations are removed from your credit report

If you're applying for credit restoration improvement, we cannot guarantee that all adverse credit notations are removed from your credit report We can only use our best endeavours to ensure that your credit record is true and correct

We can only use our best endeavours to ensure that your credit record is true and correct We will not provide you with any Insolvency services unless and until we've advised you that you may obtain help, free of charge, with credit and debt related problems from community based financial counsellors.

We will not provide you with any Insolvency services unless and until we've advised you that you may obtain help, free of charge, with credit and debt related problems from community based financial counsellors.